Abu Dhabi, May 19, 2025 – Gold has long been seen as a safe investment, especially during times of economic uncertainty. Gold rate in Dubai, which saw a meticulous high this past year, is now going down a spiral by dropping significantly. This brings a lot of questions and conclusions, one of them being, is the drop going to stay, or is it temporary?

According to a new report from ICICI Bank Global Markets, this drop may not stick around for long. They expect gold to trade between $3,050 and $3,250 per ounce in the second quarter of 2025, pointing to a period of stability rather than another big jump.

How Does This Mechanism Work?

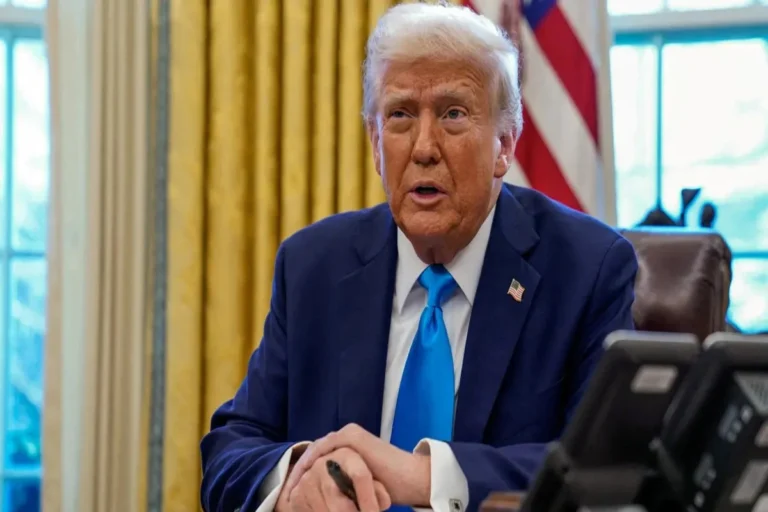

The gold rate in Dubai surged on Thursday, April 10, by 4 Dirham per gram in just one trading day. The spike came in response to US President Donald Trump’s announcement on Wednesday, 9 April, that tariffs on Chinese imports would increase from 104 percent to 125 percent, despite a 90-day pause on tariffs for other countries. Following a 25% rally between January and April 2025, global gold prices dropped by 4% over the past fortnight as concerns over the US-China trade war eased.

The gold rate in Dubai went up a lot because central banks and China started buying gold when it was around $2,800 to $3,000. After that, big investors joined in, too. This pushed the price up to $3,500, but then the price needed to come down a bit because it went up too fast. Bankers aren’t worried about this gold rate drop because the high price wasn’t completely natural; it was a bit too much, too quickly. They believe gold will stay strong around $3,000, which is a good chance for people who want to buy gold at a lower price to get back into the market.

Quantitative Drop in Gold Rate in Dubai

- Gold was $3,500 per ounce on April 22.

- It dropped from $299 to $3,201 per ounce by May 18.

- That’s an 8.5% decrease.

- In Dubai, gold was Dh420 per gram in April.

- It dropped from Dh34 to Dh386 per gram by May 18.

- That’s an 8.1% decrease.

Future Predictions

According to Wael Makarem, financial markets strategist lead at Exness, the gold rate in Dubai went up a lot, from $3,000 to $3,500, because people were worried about problems between the US Federal Reserve and President Trump’s administration, the trade war, and world political tensions.

As smaller deals are taking place, talks are ongoing to reduce political tensions. Because of this, people feel less worried and are more willing to take risks by investing. Since more people are investing in stocks, the demand for gold is going down, so the gold rate in Dubai is starting to fall. If these positive developments continue without any big surprises, the gold rate in Dubai might go below $3,000 again. Also, the US and European stock markets have gone up about 20%, showing that investors are more confident now.

“The biggest catalyst in the gold rally was central banks, and China bought when gold was $2,800 and even around $3,000. The big institutions followed. But the huge peak that followed and the price reached $3,500; it needed a correction. But we are not worried about this correction because it corrected another momentum that was not that logical. We see strong support around $3,000, and it’s good for those who were waiting for the dip to re-enter the market,” said Farah Mourad, senior market research analyst at Equiti, also sees “a strong cushion” around the $3,000 level.

Country-Specific Impact

Dubai is a major global hub for gold trading and refining, so the fluctuating gold rate in Dubai have a direct effect. Fluctuating gold prices affect Dubai’s import and export business since the city imports raw gold and exports jewelry and refined products. Dubai’s gold “souks” and trading markets see changes in activity based on price shifts, influencing business for traders and retailers.