September 27, 2025 | Dubai, UAE: Recent regulatory changes in India and the UAE have transformed how Indian buyers can pay for property purchases, creating new compliance challenges for the largest foreign investor group in Dubai’s real estate market. With the UAE Central Bank’s February 2025 mortgage rule changes and India’s heightened scrutiny of foreign investments, prospective buyers must navigate stricter payment channels to avoid regulatory penalties while capitalising on the Dubai real estate market’s continued growth.

FEMA Compliance and Payment Channel Restrictions

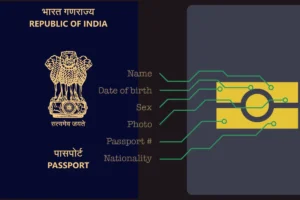

Indian buyers face strict regulations under the Foreign Exchange Management Act (FEMA) when purchasing property in UAE. The Reserve Bank of India prohibits resident Indians from using credit cards for capital account transactions, including overseas property purchases, even for small booking amounts. Any payment made through Indian-issued credit cards bypasses the required documentation and oversight, making such transactions non-compliant with RBI guidelines.

The Liberalised Remittance Scheme (LRS) provides the only legal route for Indian buyers, allowing residents to remit up to $250,000 per financial year for overseas property investments. This limit applies across all LRS purposes, requiring careful structuring for larger investments. As one Mumbai-based chartered accountant notes, “Even a token payment of ₹10,000 on a credit card can trigger FEMA violations, potentially resulting in penalties three times the property value”. All payments must flow through authorised banking channels with proper documentation to ensure compliance.

UAE Central Bank’s New Mortgage Rules Impact

The UAE Central Bank’s February 2025 directive significantly increased upfront costs for all property buyers, particularly affecting Indian buyers who rely on mortgage financing. Banks can no longer finance the 4% Dubai Land Department fee and 2% real estate brokerage commission within mortgage packages, forcing buyers to pay these costs separately. For a ₹2 crore property, buyers now need an additional ₹12-14 lakh upfront beyond the standard 20-30% down payment.

This change particularly impacts Indian buyers who previously structured payments to maximise their $250,000 LRS limit across multiple years. Dubai-based real estate consultant Arjun Mehta explains, “Earlier, buyers could spread costs through mortgage financing. Now they need liquid funds immediately, making cash flow planning crucial for compliance with both FEMA and UAE regulations”. The new rules promote financial responsibility but require buyers to have substantially higher liquidity at the time of purchase.

Structuring Payments Within Legal Frameworks

Smart structuring becomes essential for Indian buyers navigating both countries’ regulations. For under-construction properties, buyers can make instalment payments aligned with construction milestones, but each payment must comply with the annual LRS limit and use authorised banking channels. Ready-to-move properties require full payment within the financial year, limiting purchases to approximately ₹2.1 crore to stay within LRS limits.

Buyers should plan remittances early in the financial year to maximise their LRS quota. One successful approach involves opening a foreign currency account in Dubai through LRS funds, then using accumulated amounts for property transactions. However, all real estate investments in the UAE must be properly documented in Indian tax returns under Schedule FA, with rental income and capital gains subject to Indian taxation despite the UAE’s tax-free status.

Compliance Monitoring and Enforcement Trends

India’s Enforcement Directorate has intensified scrutiny of Dubai property investments, particularly focusing on cash payments made in India and adjusted against overseas transactions. Recent investigations have slowed transaction volumes, though buyer interest remains strong, with Indians comprising nearly 50% of Dubai’s prime residential market purchasers. Regulatory attention now extends beyond metropolitan buyers to tier-2 and tier-3 cities, indicating comprehensive monitoring.

The government’s increased vigilance stems from reports of informal payment channels that circumvent official banking systems. “Previously ignored transactions are now under the microscope,” warns a compliance expert. “The focus has shifted from transaction approval to post-transaction verification, making proper documentation crucial from day one”. Buyers must maintain comprehensive records of fund sources, remittance purposes, and property documentation to avoid penalties ranging from fines to criminal prosecution.

Strategic Recommendations for Prospective Buyers

Indian buyers should prioritise compliance over convenience when structuring UAE property purchases. Start with LRS-compliant wire transfers from Indian banks to developer escrow accounts, which most Dubai developers now handle seamlessly. Avoid any credit card payments, informal money transfer channels, or cash transactions that could trigger regulatory scrutiny.

Plan liquidity well in advance, considering the increased upfront costs from UAE’s new mortgage rules. For larger investments, consider structuring purchases across financial years to optimise LRS usage, but ensure each transaction remains compliant. Engage qualified tax advisors familiar with both Indian and UAE regulations, as cross-border compliance requirements continue evolving. The Dubai real estate market offers compelling opportunities for Indian buyers, but success now depends more than ever on meticulous regulatory adherence and strategic financial planning.