Dubai, UAE, May 25th, 2025: Real estate in Dubai happens to be a very dynamic and attractive investment arena, supported by strong laws and great appreciation from worldwide investors. However, underneath this surge lies a new challenge unlicensed brokers have emerged, converting kickbacks into a widespread culture undermining market credibility and the service quality provided to clients.

Dubai Real Estate Market: An Overview

Dubai property sector is somewhat expanding, with heavy selling and strong prices under its regime. In 2025, during the first quarter, residential sales surpassed AED 120 billion, with average residential prices soaring by about 5.6% year over year. The real estate in Dubai market retains its strength due to:

- High foreign investor participation (over 58% of transactions)

- Strong yields (6%–9% net, depending on location and asset class)

- Zero property taxes and political stability

- Fast-moving inventory, with average days-on-market being just 34 days

Top dollar prices are fetched by downtown Dubai and Palm Jumeirah, with areas like Dubailand offering promising rental yields, giving investors from all over the world a fair choice to invest.

Rules & Regulations of Real Estate in Dubai

Real estate in Dubai has put stringent regulations in place to guarantee transparency, safety, and protection to investors. The DLD and RERA are the very heart of the said structure. Pertaining to the key regulations are the following:

- Broker Licensing: Any real estate agent must get a RERA certificate, or else the fine of AED 50,000 per violation, and suspension or blacklisting shall be imposed on him.

- Escrow Accounts: Money raised for off-plan projects has to be held in fixed RERA-approved escrow accounts, thus protecting buyers and making sure that funds are used for the purpose of completing the project.

- Advertisements and Marketing Procedure: RERA has to approve all advertisements promoting properties, which also have to carry QR codes for authentication.

- Tenancy Law: Increases in rent are regulated and require a notice of 90 days through the Ejari system, which registers and safeguards rental contracts.

- Foreign Ownership: Foreigners are allowed to buy property in designated freehold areas, facilitating international investments while regulatory control remains.

- Dispute Resolution: RERA serves as the authority to settle tenancy and transaction disputes for fair and timely outcomes.

Interview Spotlight: Krishna Kumar Roy on Kickbacks and Unlicensed Brokers

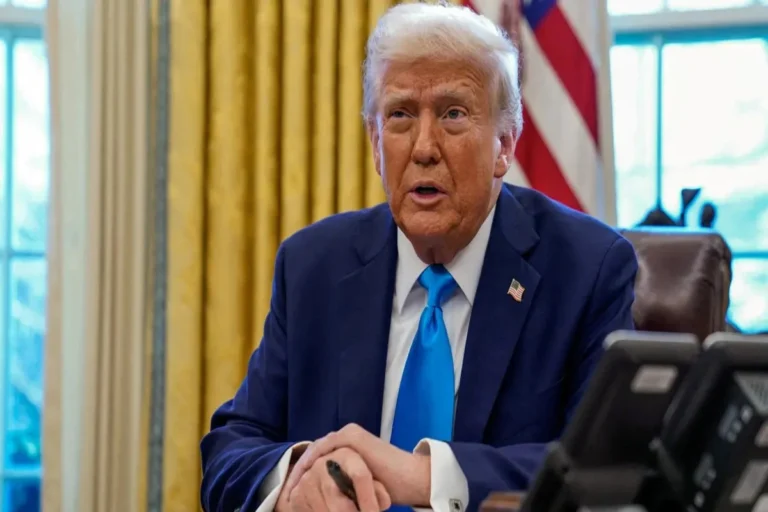

Now, We had the pleasure to interview Mr. Krishna Kumar Roy, a highly enthusiastic Real Estate Relationship Manager with Know Real-estate Company, Dubai. Mr. Roy, with more than five and a half years of experience in the field and having generated an excess of AED 300 million in property sales, has seen the face of real estate in Dubai landscape from both an old and new point of view.

Mr. Krishna Kumar Roy, originally from Nepal and educated in India, has built a reputation for integrity and performance in real estate in Dubai sector. As a Relationship Manager, he has managed the complete sell-out of premium buildings like Durar 1 and consistently ranks among the top performers. His viewpoint stands for the utmost ethical practices and client service, making him a respected voice in the industry.

The Kickback Issue in Dubai Real Estate

Mr. Roy highlighted a growing concern: the rise of kickback culture, particularly among unlicensed brokers. An illegal commission paid to some third party (usually a client or an intermediary) to influence a transaction or close a deal is called a kickback in real estate parlance. Although some clients might consider a kickback a good deal in the short term, it affects the professionalism and future viability of the market.

“The kickback culture is damaging the real estate in Dubai. When agents aren’t compensated fairly for their work, it devalues the entire sector. Licensed, experienced brokers are losing out to unlicensed agents who offer lower rates by cutting corners, often at the expense of service quality and legal compliance.”

— Krishna Kumar Roy

The Impact of Unlicensed Brokers

- Increasing Numbers: Unlicensed brokers are proliferating, often operating without the required RERA certification or DLD registration.

- Service Quality: Clients may be lured by lower costs but often receive subpar service, lack legal protections, and risk financial loss.

- Market Integrity: Licensed brokers, who invest in training and compliance, struggle to compete with unlicensed operators willing to flout regulations for a quick deal.

- Reputation Risk: The prevalence of kickbacks and unregulated actors erodes trust in the market, potentially deterring serious investors.

Why Kickbacks Are a Problem

- For Licensed Brokers: Kickbacks eat into the structures of commissions, thereby making it difficult for a legitimate practice to be maintained by brokers and for them to provide high-quality service.

- For Clients: A kickback could be felt as a discount; it may often bring undue risk-they may have no after-sales support, legal proceedings, and in case of any disputes, one cannot even complain.

- For the Market: Making kickbacks normal will disvalue the profession, discourage ethical practices, and hurt long-term stability.

Dubai Government’s Response

The Dubai government, through DLD and RERA, is actively combating real estate in Dubai issues:

- Strict Penalties: Fines of AED 50,000 for unlicensed brokerage, with repeat offenders facing blacklisting and criminal charges.

- Verification Tools: The Dubai REST app and DLD’s online services allow clients to verify broker credentials instantly.

- Awareness Campaigns: Public education initiatives encourage clients to engage only with licensed professionals and report violations.

- Escrow and Transparency: Mandatory escrow accounts and advertising regulations ensure that only verified projects and agents operate in the market.

Real estate in Dubai remains a strong and desirable prosperous sector, but the threats posed by a kickback culture and unlicensed brokers have to be mercilessly watched out for, both by the clients and the professionals. When investors are well aware of the legalities, verifying broker credentials, and insisting upon adherence to ethical codes, their interests are safeguarded; while at the same time, they contribute to the continued growth and recognition of real estate in Dubai market.

Read More: