August 1, 2025 | Dubai, UAE: A big change is coming to the way we spend, save, and send money in the UAE and it’s the use of Digital Dirham. Supported by the UAE Central Bank, this isn’t just some random fintech app or a crypto coin. It’s real money, powered by advanced technology and designed to make everyday transactions simpler, faster, and safer.

From grocery runs to even paying school fees, the use of Digital Dirham is expected to become a normal part of life in few days for millions of residents. And with the UAE’s push for a smarter economy, this shift will shape the future of digital payment in UAE like never before.

What Is the Digital Dirham And Why Does It Matter?

The use of Digital Dirham means your money will still be the same trusted UAE Dirham, just in digital form. You’ll be able to use it across stores, online platforms, and even to pay government fees. But unlike traditional cash or cards, it won’t need a physical bank or even a bank account.

It’s launch is expected by the end of 2025, this new system aims to do digital payment in UAE more efficient, especially for those people without easy access to banking services.

You can use it anywhere, whether you’re sending money home, buying groceries, or splitting dinner bills, the use of Digital Dirham will make it smoother and cheaper.

How Will It Change Everyday Spending?

Here’s what you can expect once the use of Digital Dirham goes live:

- Faster transfers with less fees, especially for international remittances

- Increased security thanks to the blockchain-backed tracking and also fraud resistance

- Instant payments at shops, restaurants, and service providers no cash or card needed

- Smart contract features for automatic rent, instalment, or subscription payments

- Access without a bank, just a digital wallet through banks or fintech apps

It’s a major step forward for digital payment in UAE, offering convenience for both individuals and small businesses.

Not Just for the Tech-Savvy

You won’t need to be a tech expert to use it. Once launched, the use of Digital Dirham will be as easy as tapping your phone. And if you don’t have a bank account, that’s fine too, the system is designed to include everyone, from salaried workers to freelancers, business owners to homemakers.

This is what makes digital payment in UAE more inclusive than ever. By making financial tools accessible to more people, the UAE is ensuring that no one is left behind in this digital shift.

Next Step for the UAE’s Financial Future

The use of Digital Dirham is just the beginning. It’s part of a much bigger vision under the UAE’s Financial Infrastructure Transformation (FIT) programme, a plan to create a fully digital economy. From buying coffee to paying utility bills or even investing in tokenised assets, the way we handle money is evolving.

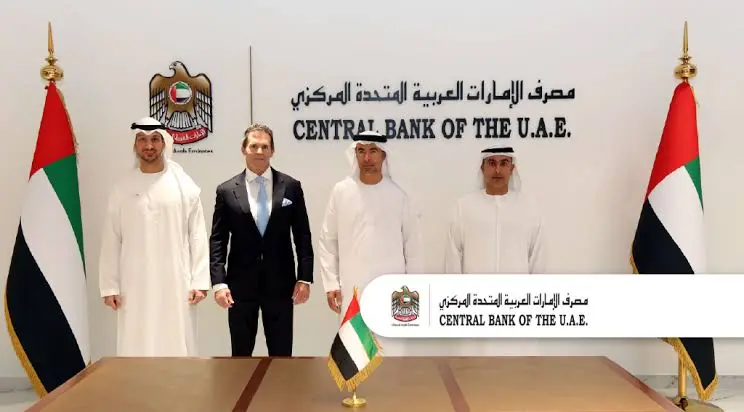

Already tested successfully with China and India, where a Dh50 million transaction cleared in just seven seconds, the rollout of the Digital Dirham shows promise. And by the end of 2025, it’s expected to be available to all residents in UAE.

This transformation is not just about convenience, it’s about building a more secure, connected, and modern financial system that benefits everyone.

A Smarter Way to Pay

The use of Digital Dirham brings great advantages to everyday life, faster money transfers and safer transactions. As the UAE takes this bold step into the future, the shift to digital payment in UAE is more than just a trend, it’s the new normal.

So whether you’re paying rent, shopping online, or sending money back home, your wallet could soon live on your phone and with it, the future of money in the UAE.

Also Read: Want to Work in Spain? Spain Visa from UAE Now Easier Than Ever