Fresh highs in bullion values sparked a surge of sellers across the Emirates, where people turned old jewelry into funds for debts and property moves. A shift in market peaks pulled everyday savers toward liquidating stashed bars and coins. Rising returns made holding onto gold feel less urgent than using it. Pressure from lending deadlines pushed some to act fast. Others eyed down payments on homes as better bets than shiny reserves. Sudden value jumps changed how many viewed their stored wealth. Cash began looking stronger than glitter as UAE Gold sales accelerated.

UAE sees rise in gold sales during high prices

Gold prices climbed fast, pushing more people in the UAE to sell their stash, driving a sharp rise in UAE Gold sales. As values spiked, locals and investors acted without delay, turning bars and jewellery into cash. Some paid off what they owed – credit cards with steep charges got cleared first. Others shifted money into real estate, seeing land and flats as steady ground when markets jump, a trend now closely linked to growing UAE Gold sales.

On January 29, gold hit an all-time peak – Dh666 for every single gram. By the weekend, that number plunged sharply, landing at Dh589.5 after a steep fall of Dh76.5. That wild swing lit a spark under sellers across the UAE, further fueling UAE Gold sales. Profit-driven moves took over, people rushing to cash out ahead of possible turbulence down the line.

Price changes spark market shifts

Thursday brought big changes for different kinds of gold, contributing further to UAE Gold sales. At one point, 22K gold reached Dh545.75 per gram, 21K at Dh523.25. Meanwhile, 18K hovered at Dh448.5 and 14K at Dh349.75. With numbers climbing like this, people in the UAE started letting go of old jewelry they’d held onto for years, increasing UAE Gold sales across local markets. Those pieces suddenly felt worth far more than before. Selling them made sense now, especially items tucked away long ago.

Downward pressure built on gold worldwide, hitting $4,893.2 an ounce – that drop of 8.14 percent traces back to the high of $5,500. A fresh face at the Fed – Kevin Warsh – took charge, nudging the US currency higher instead. With each jump in the dollar, sellers across the UAE moved faster, locking in profits before values dipped again and pushing UAE Gold sales even higher.

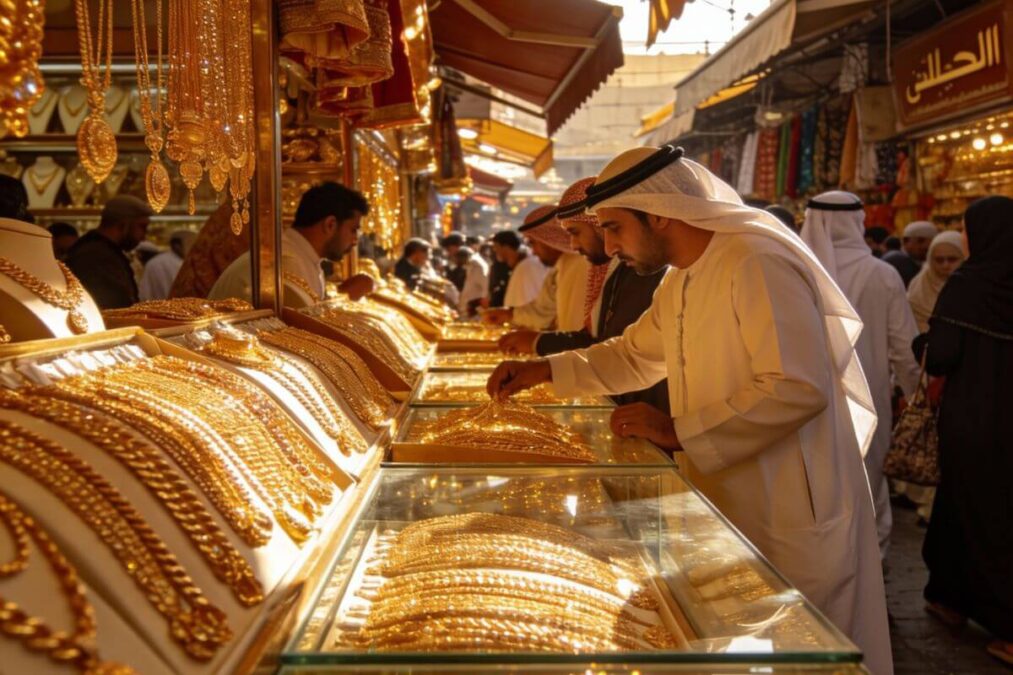

Long Lines at Gold Markets

Outside big trading spots like Dubai Gold Souk, lines stretched early as UAE Gold sales surged on the ground. People showed up by the dozens come Thursday, then again Friday. Not just individuals with a few pieces – even those holding bigger collections joined in. The mood shifted fast near the souks as more walked out than stepped in, reflecting the spike in UAE Gold sales.

Out of nowhere, people started bringing old jewelry to stores – pieces forgotten in drawers for ages. Turns out, trading gold isn’t just about timing the market anymore; it’s part of money plans now, with UAE Gold sales becoming a financial strategy.

Residents Talk About Their Own Earnings

Living in Dubai for almost thirty years, Shehzadi Rehman decided to sell gold like many others lately, joining the wave of UAE Gold sales. Her old jewelry brought in 25 percent more than what she originally paid. Others in her family saw profits go even higher, she said. That outcome surprised nobody who knew how prices had shifted.

“A lot of people are selling gifts they never use,” she said. “This phase of UAE Gold sales is helping families free up cash for bigger goals, including foreign investments and property purchases.”

Now it’s more about saving than sentiment, she says, as prices rise and goals shift. What once felt personal now often feels practical, given how expensive life has become. Jewellery keeps losing its heart to numbers on a balance sheet, one decision at a time, especially amid rising UAE Gold sales.

Move to Property Investing

A big reason more people in the UAE are selling gold is Dubai’s property scene, which has been on a solid run and is closely tied to rising UAE Gold sales. Over five years, home prices kept rising – sometimes by plenty each year. Though things seem to be leveling off now, results still beat those seen in numerous world cities.

Now buying houses with money from sold gold, some renters see a way past climbing lease bills, a shift supported by increased UAE Gold sales. Owning becomes possible when old jewelry trades for keys instead. A home bought today blocks tomorrow’s rent hikes. Savings grow quieter but deeper once bricks replace leases.

Silver Faces Heavy Selling Pressure

Now it’s not just about gold. Silver’s caught attention too, especially with people moving assets while UAE Gold sales remain strong. When prices hit $94 an ounce, Dubai local Mayank Dudeja let go of 35 percent of his silver stash, then trickled out more bits later on.

He noted that peer influence and fear of missing out contributed to both buying and selling decisions. “When prices started falling, social media was full of advice to exit quickly, which fueled more UAE Gold sales and silver liquidation,” he explained.

Social Media and Market Psychology

Quick moves in UAE gold markets owed much to crowd feelings, further amplifying UAE Gold sales. Talk online grew louder, feeding worry about falling prices, so certain buyers decided to exit fast. Still, plenty kept portions aside, mixing sale choices with plans meant to last years.

Still, feelings shape choices just as much as numbers do, even though analysts point to prices and real estate options steering UAE Gold sales right now. What drives people isn’t only profit – hidden motives often pull harder than market shifts. Decisions about bullion rarely follow logic alone when personal instincts step in.

Outlook for Precious Metals

Prices dipped lately, yet a few traders still see an upside ahead. Not long from now, silver might hit $100 an ounce once more, says Dudeja – even if things drift without direction for a while.

A sudden shift sees Emiratis trading gold more often, simply because budgets need adjusting, loans weigh heavy, or property feels safer than paper promises. Quietly, this habit reveals how closely gold still ties into everyday money decisions across homes in the UAE, with UAE Gold sales expected to remain an important financial trend.

Also Read: UAE Petrol Prices February 2026 Drop, Giving Drivers Relief at the Pump